Josephine Flood | CNBC

Josephine Flood | CNBC

On the surface, retirement planning hasn’t changed all that much over the years. You work, you save and then you retire. But while the mechanics may be the same, today’s savers are facing some challenges that previous generations didn’t have to worry about.

First of all, life expectancy is longer, which means you’ll need your money to last longer – potentially into your 90s. Bond yields are also much lower than they used to be, which means you can’t buy a few fixed income instruments and earn a double-digit return. Then there is the health crisis due to the coronavirus pandemic.

This is compounded by the fact that more companies are moving away from defined benefit pensions —which guaranteed you a certain amount of money in your golden years — to defined contribution plans, which are more subject to market ups and downs.

So, how can you have the retirement you’ve always wanted? After all, retirees want to experience all the things they couldn’t do when they were too busy working. Exotic travel vacations, marathon running, novel writing, spending more time with friends and family — the possibilities are almost endless. There are several steps, which we explain in this retirement guide, from budgeting and setting goals to choosing the right retirement savings account that will help you map out a plan that’s right for you.

This guide lays out steps to focus on to get you working on retirement planning. Follow along from start to finish, or jump to the section(s) you want to learn more about.

One of the hardest parts about preparing for retirement is thinking about life as a 70-something. A lot of people get so overwhelmed about saving for an unknown future, that they end up not saving anything at all. Thankfully, planning for retirement is not overly onerous, but you will need a road map — one that can evolve over time — to keep you on track.

The first place to start is to think about what your life might look like in retirement. Sit down with a pen and paper and write down your retirement goals.

Then think about how much everything will cost. We don’t know what prices will be like in the future, and in recent years inflation has run below the Fed’s benchmark of 2%, but the average inflation rate in the U.S. over the past century (1913-2013) was 3.22%. So plan for higher prices in the decades ahead. You’ll also want to factor in your day-to-day expenses, like housing costs, food and health care. Remember, some of the costly expenses you have now, such as a mortgage or childcare costs, will no longer exist, which could result in a decrease in your overall expenses as you near retirement.

Next, add up all the income you might receive in your post-working years. Factor in pension income if you have one, social security payments and any other dollars, such as rental income from a property, that may come your way. Match up revenue and expenses and you’ll get a good idea of what you’ll need to set aside for every year of your retirement.

Here are some things you should factor into your calculations:

● Housing costs, including rent or a mortgage, heating, water and maintenance

● Health-care costs (Fidelity estimates that the average couple will need $295,000 in today’s dollars for medical expenses in retirement, excluding long-term care.)

● Day-to-day living, such as food, clothing, transportation

● Entertainment, including restaurants, movies, plays

● Travel, including flights, hotels, gas if driving

● Possible life insurance

What’s the magic number to hit for a golden retirement?

Over the years, finance experts have said that people need to save $1 million — that’s recently climbed to $2 million as the cost of living and age demographics have changed. Some advise that you need to save 80% to 90% of your annual pre-retirement income, or that you need to save 12 times your pre-retirement salary. Those numbers and formulas can be a guide, but they’re not gospel — everyone’s situation will be different.

While starting early is always important – even $25 a month in your 20s is helpful – it’s OK to set money aside for more immediate needs first and then start tackling retirement in your late 30s and early 40s. However, you don’t want to wait much beyond that because you’ll need time to put money into a retirement account for that money to grow. The longer you wait the more you’ll have to sock away yearly making the challenge a lot more difficult.

Things to keep in mind when getting started

This is your current budget, which takes into account all of your present-day income and expenses. While you should have some idea as to what you’ll need to save per month based on your retirement goals, you also need to make sure that you have that money to save. It’s a good idea to put retirement savings as a line item in your budget, just like food and shelter costs, so that you can set aside those funds every month.

This is a tool you can set up between your checking account and your retirement account so you don’t forget to save. Set it up so that on the same day every month — maybe it’s the day you get paid — funds you’re earmarking for the future go from your bank account into your investments. By doing it this way, there’s no risk of you spending that money.

Having a separate emergency account — usually with about three to six months of salary saved up — will allow you to cover any unexpected costs without throwing your retirement plans out of whack.

One goal for everyone should be to reach 65 debt-free. That includes credit card debt — and especially the high-interest reward card kind — car and mortgage loans, any student and other big loans. The reason is simple: you don’t want to be going into your non-earning years owing money.

ACCOUNT COMPARISON CHART

| IRA | ROTH IRA | 401(K) | ROTH 401(K) | SIMPLE IRA | SEP | |

|---|---|---|---|---|---|---|

| PRE-TAX | ✓ | ✓ | ✓ | ✓ | ||

| AFTER-TAX | ✓ | ✓ | ||||

| TAXED UPON WITHDRAWL | ✓ | ✓ | ✓ | ✓ | ||

| CONTRIBUTION LIMIT | $6,000 | $6,000 | $19,500 | $19,500 | $13,500 | $57,000 |

| CONTRIBUTION LIMIT FOR 50 PLUS | $7,000 | $7,000 | $26,500 | $26,500 | $16,000 | N/A |

| 10% TAX HIT IF MONEY WITHDRAWN BEFORE 59.5 | ✓ | ✓ | ✓ | |||

| 72 WITHDRAWL AGE | ✓ | ✓ | ✓ | ✓ | ||

| INDIVUDAL ACCOUNT | ✓ | ✓ | ||||

| EMPLOYER-OFFERED ACCOUNT | ✓ | ✓ | ✓ | ✓ | ||

| EMPLOYER MATCH MAXIMUM WITHOUT CATCH-UP | $37,500 | $37,500 | 3% of compensation | $57,000 or 25% of net earnings |

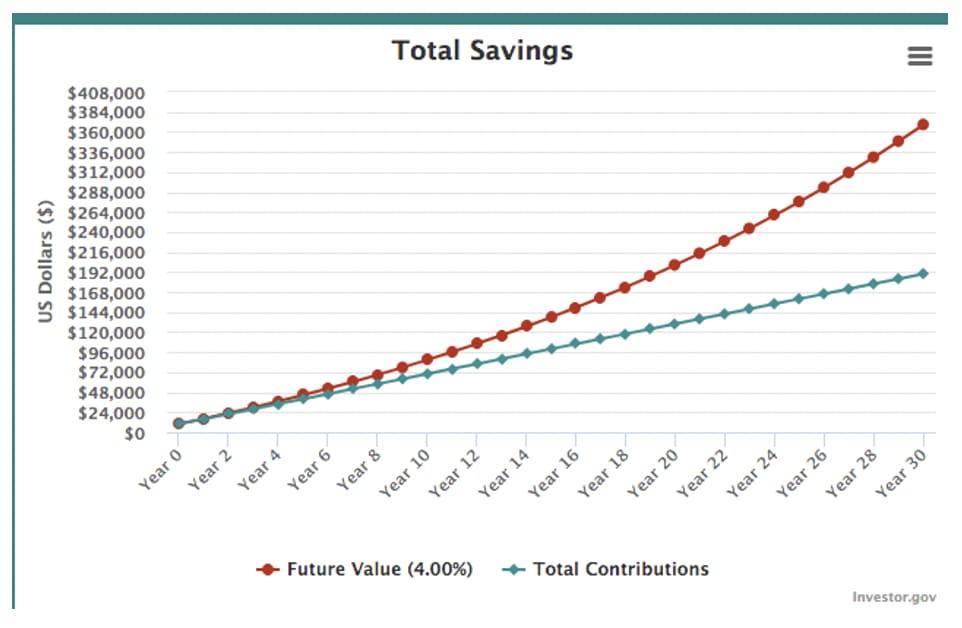

Setting aside a certain amount of money every month is, of course, the most critical part of retirement savings. But you won’t reach your goal without putting that money into the market. One reason to invest is because you want to take advantage of the power of compounding, which is when gains grow on top of other gains. For instance, if you invest $100 in one year and it goes to $110 the next, your next year’s gains will be on top of the $110, not the original amount you put in. Over time, that compound growth can really boost returns. No matter what account you use, your investments will compound year after year. (Losses can compound as well, but, fortunately, over time, markets have climbed.)

Accounts you can use for retirement savings:

High-yield savings account

It’s risk-free — money inside of a federally-insured savings account does not get invested in stocks or bonds — but you’ll make next to nothing on the funds in the account. Currently, the highest-yielding savings accounts are under 1% on the dollars saved, and have been trending down with current Federal Reserve policy to keep its benchmark rate lower for longer. Your money should grow more over time in a more traditional investment savings vehicle.

Traditional Individual Retirement Account (Traditional IRA)

The IRA is a tax-advantaged investing tool for individuals to earmark their retirement savings. Depending on the individual’s employment status, IRAs can be of various types and have different tax liabilities. As the name suggests, it’s an individual account that you open and contribute to yourself. One of the benefits of the traditional IRA, as it’s called, is that contributions are, generally, tax-deductible. So, for example, if you contribute $6,000, your taxable income will decrease by the same amount.

As well, the money can grow inside the account on a tax-deferred basis, which means you don’t have to pay tax on any investments until you withdraw. That allows your money to compound at a faster rate than it otherwise would. You will have to pay tax on the amount you take out of the account, but it’s based on your current year’s tax rate. That’s a good thing: since you typically earn little income in retirement, you’ll be in a lower tax bracket, which means your tax hit on those withdrawals will be minor. (There is usually a 10% penalty for withdrawing funds before you turn 59 1/2 years-old, though you can remove up to $100,000 tax-free if you’ve been negatively impacted by Covid-19. See the IRS website for more.)

Rules regarding maximum contributions and income limits for IRAs can change annually. As for how much you can contribute, currently you’re allowed to invest $6,000 per year, though those 50 and older can save up to $7,000 a year using what’s called catch-up contributions. Once you turn 72, though, you must start removing money from your IRA. The minimum required distribution will vary based on your account size and life expectancy, so talk to an accountant or an advisor before withdrawing. If you don’t withdraw the required amount you could get hit with a hefty tax penalty.

Roth IRA

Roth IRAs are different than traditional IRAs in two meaningful ways. The first is that contributions are made with after-tax dollars, which means you don’t get a tax deduction when you invest. The upside is that when it comes time to withdraw you will not owe the IRS a thing. All of your contributions can, therefore, grow tax-free over time. Like the IRA, you can only contribute $6,000 a year or $7,000 if you’re over 50. There is one caveat: if you earn more than $122,000 or if you and a spouse earn more than a combined $193,000, your annual contribution room will be reduced. If you earn more $137,000 individually or $203,000 as a couple, you cannot contribute to this account.

Simple IRA

Many small businesses don’t offer 401(k) plans, which can be expensive to set up and maintain. They are allowed to offer a SIMPLE IRA, which stands for Savings Incentive Match Plans for Employees. It works in a similar way to a 401(k), in that both employees and employees can contribute funds, which reduce each side’s taxable income by the amount that each party invests. For 2022, the annual contribution limit for SIMPLE IRAs is $14,000, up from $13,500 in 2021. Workers age 50 or older can make additional catch-up contributions of $3,000, for a total of $17,000. Employers can only contribute up to 3% of their staff member’s annual compensation. Contributions can grow tax deferred, until the age you have to withdraw.

Traditional 401(k) plans

A 401(k) is a retirement account offered by a company for its employees. Contributions into this account are pre-tax, which means that like the traditional IRA they can grow on a tax-deferred basis. You will have to pay the taxman when you withdraw those funds, but if you’re in a lower tax bracket in retirement than you were during your working years, then that tax hit shouldn’t be too great.

There are several benefits to the 401(k). One is that the contribution limit is much higher than it is with an IRA. Workers who are younger than age 50 can contribute a maximum of $20,500 to a 401(k) in 2022, up from $19,500 in 2021, or $26,000 if you’re over 50. Employers are also allowed to match contributions — though the percentage of contributions they match and the amount matched per employee dollar does vary. Using Vanguard Group-managed retirement plans as an example, in 2019 it reported an average employee contribution rate of 7.0%, and average employer contribution rate of 3.7%.

In 2022, the total employer and employee contributions combined cannot exceed $61,000 or 100% of your salary (that’s $67,500 for those under 50 and older). There’s also a lifetime contribution limit of $305,000. Another key feature is that money gets automatically removed from your check and put into the 401(k), so you don’t have to worry about moving those dollars into the account yourself.

Like the traditional IRA, you will get hit with a 10% tax if you withdraw money before you turn 59 1/2. However, for now, you can remove up to $100,000 from a 401(k) if you or your spouse has lost a job or you’ve been negatively impacted by Covid-19 without the 10% withdrawal penalty.

Roth 401(k)

This is an employer-sponsored account that’s funded with after-tax dollars. Like the Roth IRA, contributions are not tax deductible, but you also won’t get hit with a tax bill when it comes time to withdraw. Like a traditional 401(k), both employees and employers can contribute, but there are limits. The maximum amount you can contribute to a Roth 401(k) for 2022 is $20,500 if you’re younger than age 50. This is an extra $1,000 over 2021. If you’re age 50 and older, you can add an extra $6,500 per year in “catch-up” contributions, bringing the total amount to $27,000. Contributions generally need to be made by the end of the calendar year.

You can split contributions between a regular 401(k) — using pre-tax dollars — and a Roth 401(k), but your combined investments can’t exceed the maximum contribution amount. This account is ideal for those who think they may be in a high tax bracket in retirement, where they would then have to pay a potentially hefty tax bill to Uncle Sam.

There are ways to roll money over from one of the above accounts to another — such as from a traditional IRA to a 401(k) and vice-versa — but it’s a good idea to get help from a financial advisor before doing anything.

Simplified Employee Pension (SEP) Plans

If you’re a self-employed individual looking to save for retirement, then the SEP plan may be the best option for you. This account, which can only be opened by a business owner with one or more employees or someone who earns freelance income, is similar to a traditional IRA in that pre-tax contributions reduce your taxable income (or the company’s depending on who is contributing) and money can grow tax-deferred until you remove it in retirement. For the self-employed and small business owners, the SEP IRA contribution limit was raised to $61,000 in 2022, up from $58,000 in 2021. You can also put money into an employee’s account, however, unlike a 401(k), which is more expensive to set up than a SEP, the staffer cannot contribute to his or her own SEP.

Years ago, retirement-focused investors would have likely put their money in a balanced mutual fund, which typically consists of 60% equities and 40% bonds. While that asset mix is still popular among savers today — you get some growth from stocks and some protection from bonds — investors now have more choice.

Here’s a look at some of the more popular investment options:

Stocks for growth

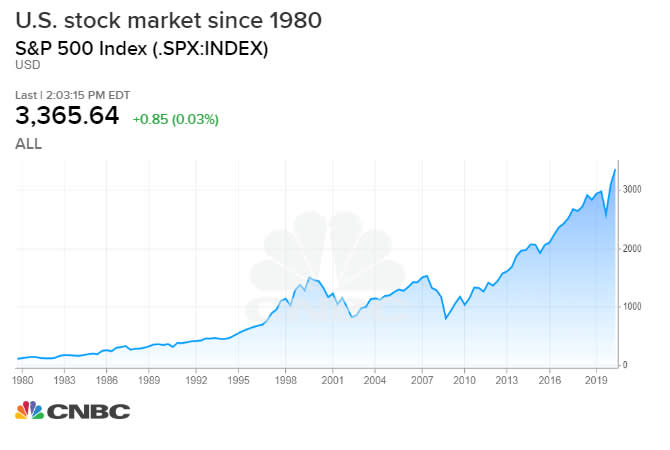

The majority of savers still buy stocks – either directly or through a mutual fund or exchange-traded fund – which are shares in a publicly listed company. Stock prices tend to rise over the long-term, which is why people buy them. Since 1926, the S&P 500 has posted a 10.24% average annual return with dividends reinvested, according to S&P Dow Jones Indices. In other words, if you invest in equities in your 30s and retire in your 70s, there’s a high likelihood that your money will have grown over those 40 years.

The downside is that stocks can fall. In the Great Recession of 2008 and the more recent pandemic stock market plunge, stock prices dropped by more than 35%, which caused a lot of problems for those in and nearing retirement.

Fortunately, while all stocks fluctuate in price, there are a lot of different kinds to choose from depending on your risk tolerance level. If you’re a more aggressive investor you might tilt a stock portfolio to sectors with higher growth potential, but also more volatility, such as technology, while more conservative investors might focus on blue-chip companies in sectors such as financials, consumer staples or industrials, where there traditionally has been less potential for the biggest gains, but also less volatility. But all stocks carry risk of losses and volatility profiles have been changing in recent years. The best way to limit exposure to stock volatility is investing through diversified equity funds rather than single-stocks or narrow sector investments.

Bonds for safety

Bonds are another popular investment for savers as they can move a lot less in price than stocks. Investors lend money to a government or company in exchange for an annual payment based on a predetermined interest rate. At the end of that bond’s term — usually between one and 30 years — you get back your original investment. Investors like bonds for two reasons: they get some guaranteed annual income and there’s less risk, depending on the kind of bond you buy, of losing any money. Because of this, bonds tend to fluctuate less than stocks and so they balance out a portfolio’s overall ups and downs.

Bonds aren’t perfect, however. First of all, there are different kinds of bonds with different risk levels. Generally, Treasury bonds, which are fixed income securities issued by the federal government, have little risk of defaulting. Even with America’s high debt load, they’re going to pay the interest on their loans. The same can’t be said for certain municipalities, which also raise money through bond issues, or companies that may be in financial trouble. If an issuer defaults, your bond could be worthless.

As well, these days interest rates are so low that you can barely earn any money from holding fixed income. Also, when bond yields rise, prices drop and vice versa. If you need to sell your bond before the maturity date and yields climb, you’ll have to sell it for a lower price than you bought it for. There’s something else: Most individuals don’t hold actual bonds — they tend to own bond funds, which hold a number of fixed income instruments, as buying a single bond is difficult for the average person to do. That fund’s value could fluctuate depending on where interest rates go. With rates so low, many people think that at some point interest will have to rise which could negatively impact the price of your bonds. Still, if you’re worried about the stock market at all, then bonds will usually help smooth out the ups and downs.

Alternative asset classes

There are many other investments to choose from and most experts recommend holding about 5% to 10% of assets in things other than stocks or bonds. Gold is a popular investment because the yellow metal’s price tends to rise during recessions and in big market declines. Depending on your level of sophistication, you can also purchase other kinds of commodities, like oil or silver, or dabble in futures and options. It’s a good idea to talk to a professional before making any outside-the-box investment decisions.

What funds should you buy?

There are a variety of funds types to consider when saving for retirement. Here are the most popular options.

Actively managed mutual funds

These funds have been around for decades and are still the most-popular kind of security among retail investors. They hold a variety of stocks or bonds, and sometimes both, in one investment vehicle. Mutual funds are ideal for people who don’t want to choose their own stocks. Instead, a professional fund manager can do it for you. If you want to own a bunch of international stocks, but don’t want to pick individual companies, then buy an international stock fund. The same goes for tech stocks, U.S. stocks and corporate bonds — there’s a fund for everything. The main drawbacks are fees and flexibility. Because someone else is doing the stock picking, fees are higher on actively managed mutual funds than on other kinds of investment vehicles. You also can’t buy or sell them during the day as they’re only priced after the market closes.

Index funds

Index funds are similar to active mutual funds, except there’s no stock picker. These funds track a benchmark index, like the S&P 500 or the broad-based MSCI World Index. One of the issues with traditional mutual funds is that most don’t beat their benchmarks especially when you factor in the higher fees. Index funds were developed to avoid underperformance — returns are the same as the index they follow. There is a management fee, but it’s a lot less than what you might find on a traditional mutual fund. Like active mutual funds, you can’t sell them during the day and they only get prices after the trading day is over.

Exchange-traded funds

ETFs are like traditional mutual funds in that they hold a basket of securities, like stocks or bonds, and they’re like index funds in that many track a benchmark. They’re different, though, in that they trade on a stock exchange, which means they’re priced in real-time and can be bought and sold at any point during the day. That’s less important for retirement investors who hold stocks for the long-term, but still, you never know when you might need to sell something. Most importantly, index ETFs are cheap. Many come with no management expense fees, while others have fees between 2 basis points and 10 basis points (0.02% and 0.10%). That’s why they have seen their popularity soar — as you’ll see later on, the more you can save on fees, the more money you can put towards your retirement.

Target date funds

One of the most popular 401(k) investments these days are target date funds, which are a class of all-in-one mutual funds or ETFs that adjust their asset class mix automatically as you age. For instance, someone who’s in their 30s in 2022 might hold a 2060 target date fund, which, right now, might hold 90% stocks and 10% bonds. As you age, the stock and bond mix will self-adjust. Once the fund reaches its target date, the allocation shifts to a 50/50 portfolio—so in the year 2060, this target date fund’s allocation will consist of 50% stocks and 50% bonds. The allocation will continue to shift toward bonds for approximately seven years after the designated date

By becoming more conservative, there’s less of a chance of losing money in the market in the few years leading up to retirement. In many employer-sponsored retirement plans, target date funds are now the default investment choice if investors don’t actively make investment selections.

Build your portfolio

A lot of people like investing on their own, but when it comes to retirement savings it’s a good idea to work with a financial advisor who has a certified financial planning designation. Here are a few things to look for in a good advisor.

- Qualifications: CFP is the most widely recognized financial advisor designation.

- Services they provide: Do they specialize in retirement planning? Can they help you create a budget? Do they sell all kinds of securities?

- Compensation: Some advisors get paid by the mutual fund companies they invest your money with, others charge an upfront fee or an hourly rate for help. The latter are usually called fee-only planners and some people think they’re more objective, since they’re not getting paid by anyone else but you.

- Track record: Ask to speak to references. You don’t need your advisor to provide stellar returns, but rather you want to make sure they’re attentive, understand your needs, can create solid plans and know how to help you invest.

- Communication: People tend to panic when the markets get bad and when their advisor doesn’t’ reach out to tell them to stay calm. Find out how often your advisor wants to meet and how they’ll be in touch. You don’t need to handholding, but you do want to meet with them at least a couple of times a year.

One of the first conversations you’ll have with an advisor is around your time horizon and risk tolerance levels, which are two key things to consider when building a portfolio.

Most advisors tell their clients to get more conservative as they get older because there’s less time to recover from a drop. That doesn’t mean you need to hold more bonds than stocks, but if you had, say, an 80% stock and a 20% bond mix, then you may want to be closer to 50-50 come retirement. This is a rule of thumb, though many people reach retirement with a big nest egg and still can keep a good portion of their assets in stocks. Just make sure that any money you need for day-to-day living is not subject to market ups and downs.

Think about fees

It’s important to assess fund management and trading fees since they can eat into profits. Even do-it-yourself investors typically have to pay commissions on some trades. Here’s an example: If you invest $10,000 in a fund with a 2% fee, and if you assume a 5% rate of return over 30 years, you’ll end up paying $19,643 dollars in fees. If you pay 0.5 % in fees, which is possible to do, you will fork over $6,034. That’s a big difference.

Active mutual funds tend to be more expensive than index funds and exchange-traded funds, which, in most cases, passively track a market index like the S&P 500. Fees on active funds have come down due to the pressure from index funds and ETFs. According to the Investment Company Institute, the average equity mutual fund fee is now roughly 0.5%. But most index ETFs and index mutual funds remain cheaper — a few ETFs even launched in recent years with no fees at all. There’s a major movement towards lower-fee investments, in general, even if not zero-fee, so expect more funds to drop their prices in the coming years, and some active mutual fund companies are starting to launch their own active ETFs as well.

While your investment portfolio is a big part of the net worth equation — which you can calculate by adding up the value of your assets and subtracting your debt — it’s not the only thing that can potentially contribute to your financial well-being in retirement. Here are five ways to increase your net worth.

Depending on where you live and when you purchased your abode, a house can end up being your most valuable asset and a lot of people do sell their home later in life and then use that money to help fund their retirement goals. Real estate can be a great asset because it tends to rise in value over time — though as we saw during the Great Recession, that’s not a guarantee by any means. While renting can be cheaper, and you can then invest the difference and potentially earn more over time than you would on a house, real estate essentially forces you to save. As you pay down your mortgage, and as the value of your property rises, your net will increase.

A business can add a lot of value to someone’s net worth — or not. While many businesses do provide a decent living for their owner, they’re an illiquid asset, often hard to value that takes time to sell. Putting a price on a business is a lot harder than coming up with a sale price for a home, though, so talk to an expert who can help you set a valuation and determine how much your operation may net.

Most people want to earn increasingly larger amounts over their lifetime. The more money you have the more you can save, put toward debt, use on buying other assets and more.

Decreasing debt increases your net worth, so, over time, do what you can to pay down your mortgage, pay off your car loan and reduce any credit card debt. At the same time, consider cutting back on some of your expenses. The lower your expenses the more you’re worth — and the more you can save.

This is a little different than the rest, but your family’s net worth will, of course, drop significantly if you unexpectedly pass away and can’t earn a living anymore. To protect them, consider buying life insurance. It won’t help you in retirement (though, some kinds do come with an investment component that you can tap into later in life) but it will help your spouse and children stay afloat if something goes awry.

How to recover from a setback

Life does not move in a straight line, which means everything from your net worth to your investments to your retirement plan will likely experience a setback at some point. You could lose a job, the market could crash, you could face a health-care crisis and more. The key with all of this is to not panic and stick to your plan.

Of course, that’s easier said than done, especially when it comes to the stock market. In March 2020, when markets dropped by about 35% due to the novel coronavirus pandemic, many investors no doubt felt an extreme sense of panic and they likely wanted to sell out of everything, fearing that markets would drop further and wipe out their nest eggs. While that’s a normal reaction, selling out may be the worst thing you can do since you can miss out on recouping those losses if there is an upswing. Few investors can successfully time the market.

At the end of September 2020, the S&P 500 was up about 1% on the year, and up 46% from the March 23, 2020 market bottom. If you sold out and and haven’t bought back in yet, you would have lost a lot of money instead of being up on the year. Furthermore, despite the continued challenges from Covid-19 the S&P 500 finished at a record high, up nearly 27% in 2021. As we mentioned earlier, the S&P 500 has posted a 10% annual return, on average, since 1920 and about a 6% annual average return since 2000. So, while there are down years, the market is up more than it’s not.

When the market does fall, don’t panic. Keep contributing your monthly amount — while you may lose some of it as the market falls, you’ll also end up buying stocks at the bottom, which will increase in value significantly as stocks rise — and, if you lose your job or are worried about an income reduction, review your budget to see where you can cut back. Try and leave savings alone until that’s no longer possible.

If you do feel overwhelmed, then that could be a sign that your risk tolerance is out of whack. If you’re worried about losing too much, then you may need to be in a more conservative portfolio where a market decline won’t impact your assets — or your psyche.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.